Despite the ongoing global COVID-19 pandemic, GDT’s future looks bright. The company expects to benefit from the Australian government’s banning of baled tyre exportation by 2021. It also formalised its joint venture with specialist company Tytec Logistics.

Find out more in this latest edition of the newsletter.

Overview

The Covid-19 pandemic has affected industry across the board and around the world.

For example, in Europe tyre collection rates reportedly fell by 80% in volume.

Meanwhile, tyre manufacturers all slowed production down due to employee safety and reduction in tyre usage.

In the U.S., state governments gave motorists a 3-month registration holiday. Fleet leases have also been carried over for three months.

Once the doors open in the U.S. and Europe, there will be a surge in demand for collection and recycling. This will turn the spotlight back on the alternatives for tyre disposal.

India is restricting the import of whole tyres, and global shipping is still in total disarray. Because of this, GDT’s international prospects have never been better. The company has also experienced considerable progress during the pandemic close-down here in Australia.

Environmental and regulatory landscape

The Australian Federal Government’s decision to prohibit the exportation of baled whole tyres also helped enhanced GDT’s prospects. The ban will take effect on 31 December 2021.

The government’s initiative provides support and opportunity for GDT’s end-of-life tyre (ELT) solution. Meanwhile, the U.S. and the UK have also begun developing similar provisions and regulations.

It is fair to say that governmental focus of waste management, particularly in ELT, has increased internationally.

Warren

Scheduled maintenance and recent investor demonstrations have restricted activity at the GDT Warren facility. The personnel numbers reflect this limited activity.

However, we expect to see an increase in worker numbers soon to help commission further modules. This will likely occur once the current fund raising is closed.

To improve the opportunities for securing workers, GDT is entering into an agreement with First People Solutions. The company is an Aboriginal enterprise in Dubbo that has a labour hire division.

While working under the pandemic, the Warren team has reviewed, rehearsed and updated the maintenance and operations manuals. These will form part of the handover of every future plant to its operating team. Every GDT facility in Australia and abroad will follow this new handover.

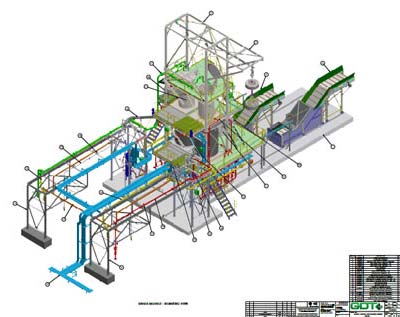

Toowoomba

The GDT Toowoomba plant remains ready to begin construction with the Development Approval and the Environmental Licence in place. Final site preparation will be completed by the landlord once funding has been confirmed.

Additionally, GDT applied for Queensland State Government Funding of $4.25 million. Meanwhile, the current equity raise will provide the $12 million balance of the plant cost.

Tytec Recycling – Joint Venture

For this business, GDT shares 50% of the ownership with our partner, the owners of Tytec Logistics.

Tytec is a specialist company that only deals with the management and processing of mining tyres in Australia and overseas.

Tytec Australia purchased a parcel of land at Coolum in Queensland to serve as an OTR tyre recycling facility.

The company has already submitted applications to Council and the Environmental Authority

All international mining tyre opportunities remain unchanged within the existing Tytec Recycling joint venture structure.

International Ventures

United Kingdom

We have completed an MOU with a UK company already operating in the

tyre collection business. They are committing to a 10% equity position in GDT.

This will help establish a new 50/50 Joint Venture (JV), which will allow the use of GDT technology in the UK and Ireland.

Our UK Partner has purchased the first site in North Lincolnshire and is currently in discussion with the authorities over permit applications.

The ELT problem in the UK is getting out of hand since Brexit and the

closure of the Indian option for the export of baled tyres.

Our partner has seen their collection numbers increase from 160t per week in January to greater than 500t per week in May, which is an indication of the increased demand.

USA

Our arrangements in the USA are similar to the JV model used in the UK.

Similarly, our intended US Partner has purchased land at Strasburg in

Pennsylvania and has agreed in principle to invest in GDT.

This is planned to be followed by further funding of up to US$150m for the

roll out of plants by the JV company. We anticipate documentation to be

completed by the end of August with the money to follow shortly thereafter.

South Africa

We have signed an MOU with our potential JV partner in South Africa,

although their pandemic lockdown has prevented any further activity at this point in time.

However, this is due to be relaxed at the end of July, assuming that some

measure of control is attained over the spread of the COVID-19 virus.